A deductible is the amount of money that an insurance policyholder must pay out of pocket before their insurance coverage begins to pay for a covered loss. In personal injury and car accident cases, the deductible is particularly relevant when filing claims for medical expenses, vehicle repairs, or property damage under an insurance policy. Understanding how deductibles work is essential for policyholders, as it affects the amount of compensation they can expect from their insurance company and the expenses they are responsible for covering. At 770GoodLaw, we help clients understand their insurance policies, including deductible requirements, and pursue compensation to minimize their out-of-pocket costs after an accident.

How a Deductible Works in Insurance Claims

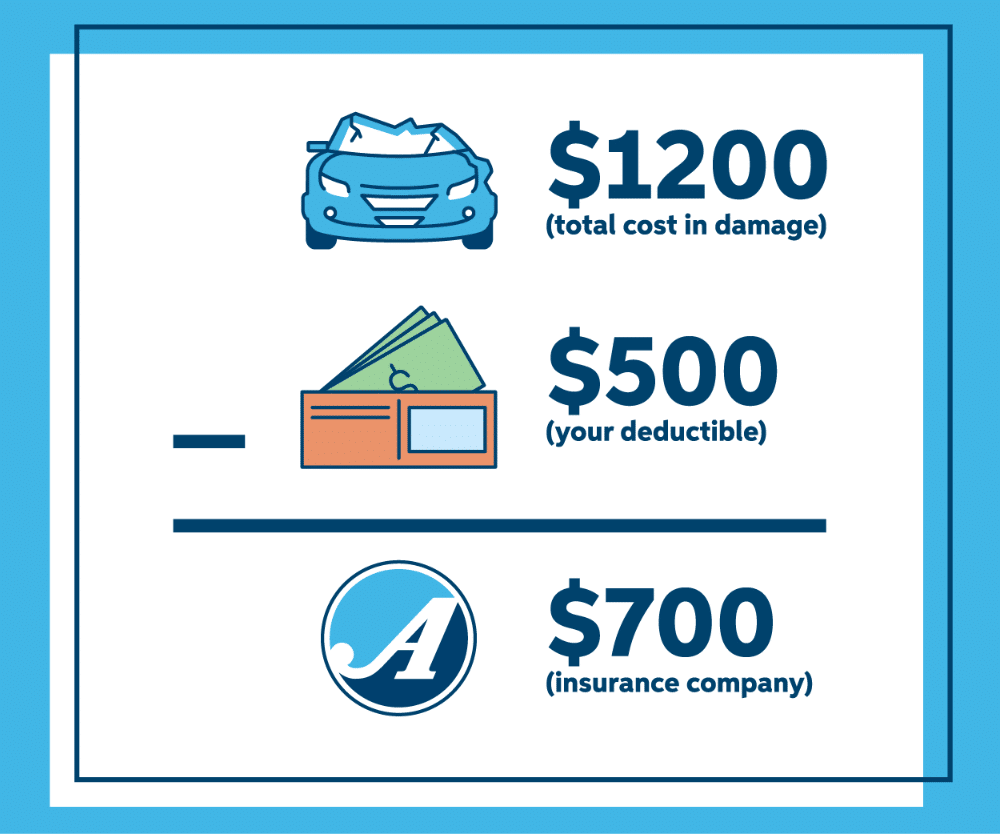

The deductible represents the policyholder’s share of financial responsibility before the insurance company covers the remaining costs up to the policy’s limit. Key aspects of how deductibles work include:

- Out-of-Pocket Payment: The policyholder must pay the deductible amount before the insurance company will cover the remaining expenses of a covered claim.

- Deductible Amount: Deductibles vary by policy and can be a fixed dollar amount (e.g., $500) or a percentage of the claim amount, depending on the type of insurance.

- Application to Each Claim: In most cases, the deductible applies separately to each claim filed, meaning that multiple claims require multiple deductible payments.

- Impact on Premiums: Policies with higher deductibles often have lower premiums, as the policyholder assumes more financial responsibility in the event of a claim.

Types of Deductibles in Personal Injury and Auto Insurance

Deductibles are common in various types of insurance policies, each serving a different purpose in managing out-of-pocket expenses. Common types of deductibles include:

-

Auto Insurance Deductible: In car accident claims, the auto insurance deductible applies to repairs or vehicle replacement costs, with the policyholder responsible for paying the deductible before coverage kicks in.

-

Health Insurance Deductible: Health insurance deductibles apply to medical expenses, requiring the insured to pay a certain amount before insurance starts to cover treatment costs.

-

Uninsured/Underinsured Motorist Deductible: In cases where the at-fault driver lacks sufficient insurance, the uninsured or underinsured motorist deductible may apply to claims filed under the victim’s own policy.

-

Property Damage Deductible: In accidents that result in property damage, the deductible applies to the costs of repairing or replacing the damaged property.

Role of Deductibles in Personal Injury Cases

Deductibles are often relevant in personal injury cases when victims file claims for medical expenses, vehicle repairs, or property damage under their own insurance policies. Important considerations include:

- Out-of-Pocket Costs: Deductibles represent an immediate out-of-pocket expense for the victim, affecting the total amount they receive from their insurance settlement.

- Impact on Settlement: When negotiating a settlement, the presence of a deductible can influence the final amount, as the victim may seek compensation to cover deductible expenses.

- Coordination with Liability Insurance: If the at-fault party’s insurance is liable for the damages, the deductible may be reimbursed by the at-fault party’s insurer as part of the settlement.

- Deductible Reimbursement: In some cases, a victim may initially pay their deductible but can recover this amount if the at-fault party is found liable and their insurance covers the costs.

Strategies for Managing Deductible Costs

Managing deductibles effectively can help minimize financial strain after an accident. Common strategies for handling deductible costs include:

-

Choosing the Right Deductible: Selecting a deductible that balances affordability and premium savings ensures that the policyholder can handle out-of-pocket expenses if needed.

-

Filing Under Multiple Policies: In some cases, victims may have access to multiple insurance policies (e.g., health and auto) that can help cover expenses, though deductibles may apply to each policy.

-

Seeking Deductible Reimbursement: If the at-fault party is insured, the victim’s insurer may attempt to recover the deductible through subrogation, potentially reimbursing the policyholder.

-

Considering Legal Assistance: Consulting an attorney can help ensure that all deductible costs are accounted for in a personal injury claim, maximizing the compensation available to cover out-of-pocket expenses.

Challenges with Deductibles in Insurance Claims

Deductibles can present challenges for policyholders, particularly when managing multiple expenses after an accident. Common challenges include:

-

High Deductible Costs: High deductible amounts may pose a financial burden for victims, especially if they require extensive medical treatment or significant vehicle repairs.

-

Multiple Deductibles: When multiple claims are filed (e.g., health and auto insurance), the victim may face multiple deductibles, increasing out-of-pocket costs.

-

Deductible Disputes: Insurers may dispute the amount of the deductible or deny reimbursement if liability is unclear, requiring legal guidance to resolve.

-

Coordination with At-Fault Party’s Insurance: When the at-fault party is liable, coordinating deductible reimbursement can be complex and may require legal intervention to ensure fair compensation.

How 770GoodLaw Assists Clients with Deductible Management

At 770GoodLaw, we work closely with clients to navigate deductible requirements, helping them minimize out-of-pocket expenses and maximize their insurance benefits. Our approach includes:

- Reviewing Insurance Policies: We carefully examine our clients’ insurance policies to understand deductible requirements and identify options for covering accident-related costs.

- Coordinating with Insurers: Our team communicates with insurance companies on behalf of our clients, addressing deductible disputes and coordinating reimbursement efforts where applicable.

- Maximizing Settlement Offers: We account for deductible costs when negotiating settlements, ensuring our clients receive fair compensation to cover their financial responsibilities.

- Seeking Deductible Reimbursement: In cases where the at-fault party’s insurance is liable, we work to recover deductible costs as part of the overall claim, reducing the financial impact on our clients.

Importance of Legal Representation in Cases Involving Deductibles

Understanding and managing deductibles in insurance claims requires familiarity with policy terms, coverage limits, and negotiation tactics. Skilled legal representation helps clients navigate these complexities, ensuring that deductible expenses are minimized and that they receive the compensation they deserve. At 770GoodLaw, we provide dedicated support for clients, guiding them through each stage of the claims process to maximize their recovery and minimize out-of-pocket costs.

Why Choose 770GoodLaw for Personal Injury and Deductible-Related Claims

Our commitment to Relentless Reliability and Sincetegrity drives us to provide comprehensive, client-centered support in cases involving deductibles and insurance claims. At 770GoodLaw, we work tirelessly to protect our clients’ rights, secure fair compensation, and help them manage deductible costs effectively.