- Is 21st Century Insurance Right for You?

When shopping for car insurance, finding a provider that’s reliable, affordable, and offers a seamless claims process is essential. 21st Century Insurance is a popular choice, offering straightforward policies and competitive rates. However, like any insurance provider, it has its strengths and weaknesses. Here’s a comprehensive breakdown, including a pro vs. con list to help you decide if it’s the right choice for you.

Overview of 21st Century Insurance

21st Century Insurance, a subsidiary of Farmers Insurance Group, focuses on affordable auto insurance with an emphasis on digital tools and customer convenience.

Key Features

- Specialized Auto Coverage: Tailored products specifically for drivers.

- Competitive Pricing: Offers affordable rates, often lower than competitors.

- Digital Tools: Provides online quotes, policy management, and claims filing for tech-savvy users.

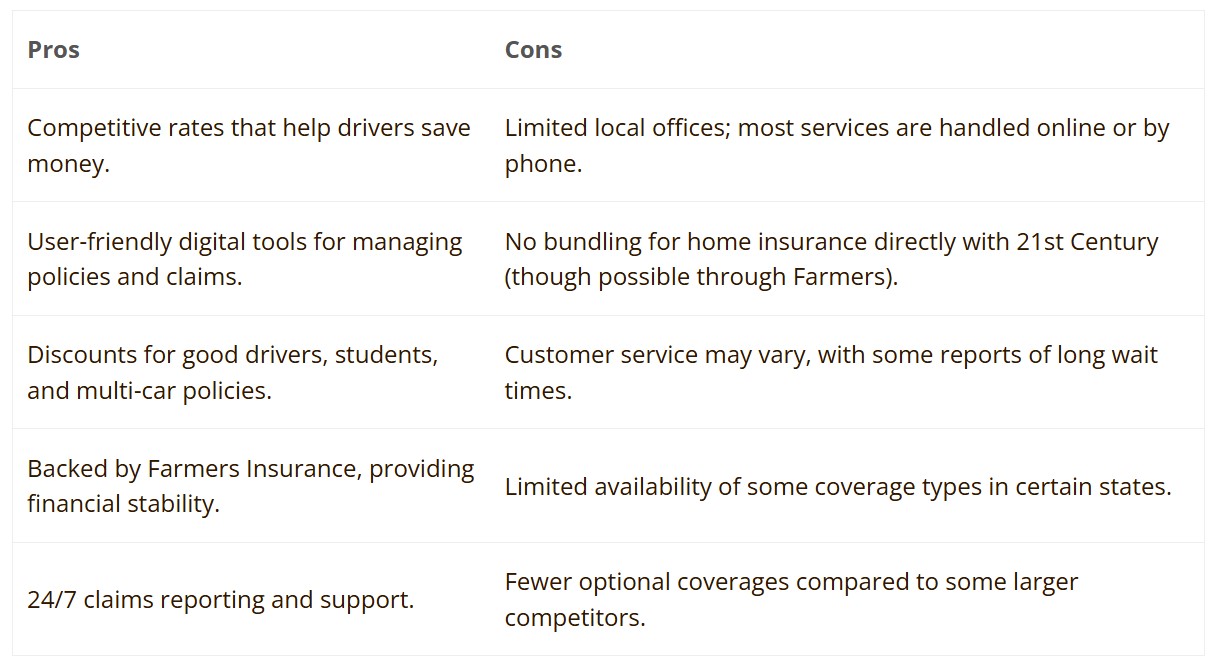

Pro vs. Con List: 21st Century Insurance

Types of Coverage Offered

21st Century Insurance provides standard auto insurance coverages to meet legal and personal needs:

- Liability Coverage: Required by law; covers damages and injuries if you’re at fault.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: Covers non-collision incidents like theft, vandalism, and weather damage.

- Uninsured/Underinsured Motorist Coverage: Protects you if the at-fault driver doesn’t have sufficient insurance.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

Filing a Claim: The Role of Your 21st Century Claim Number

Your claim number is critical when filing a claim. It serves as a unique identifier for tracking your claim’s progress.

Steps to File a Claim

- Report the Incident: Call or file a claim online immediately after the accident.

- Provide Information: Submit your policy number, accident details, and any supporting documents.

- Receive Your Claim Number: This will be your reference for all updates and communication.

- Assessment and Repairs: A claims adjuster will evaluate the damage and guide you through the repair or settlement process.

- Track Your Claim: Use the online portal or customer service hotline to check your claim’s status using the claim number.

Contact Information

- Claims Department: 1-888-244-6163

- Online Claims Filing: 21st Century Insurance Website

Discounts and Savings Opportunities

21st Century Insurance offers several discounts that can significantly reduce premiums:

- Good Driver Discount: Save money with a clean driving record.

- Multi-Vehicle Discount: Insuring more than one car results in savings.

- Good Student Discount: Students with high grades can qualify.

- Bundling Discount: While you can’t bundle directly with home insurance, you can bundle with Farmers Insurance.

Accident Coverage with 21st Century Insurance

Accidents can lead to costly repairs and medical expenses, but 21st Century Insurance offers accident coverage designed to protect you financially.

Key Components of Accident Coverage

- Bodily Injury Liability: Covers medical costs and legal fees if you injure someone.

- Property Damage Liability: Pays for damage to another person’s property.

- Collision Coverage: Repairs or replaces your car after an accident, regardless of fault.

- Medical Payments (MedPay): Covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Protects you if the at-fault driver lacks insurance.

Add-On Accident Coverages

- Roadside Assistance: Covers towing and minor repairs like tire changes.

- Rental Car Reimbursement: Pays for a rental car while yours is being repaired.

- Gap Insurance: Covers the difference between your car’s value and the remaining loan balance if totaled.

How 21st Century Handles Accident Claims

- 24/7 Support: Immediate assistance for claims reporting.

- Towing and Repairs: They’ll arrange towing and provide recommendations for repair shops.

- Claims Adjuster: Evaluates damage and estimates repair costs.

- Settlement: Once approved, the claim is settled based on policy limits and deductibles.

Is 21st Century Insurance Right for You?

21st Century Insurance is ideal if you’re seeking:

- Affordable, straightforward auto insurance.

- Strong digital tools for managing policies and claims.

- Competitive discounts for safe driving and multi-car policies.

However, it may not be the best fit if you:

- Prefer face-to-face interactions with agents.

- Want extensive optional coverages or need to bundle multiple policies.

Pro Tip: Keep your claim number and all documentation organized when filing a claim to ensure a smooth experience.

Would you like a deeper comparison of accident coverage from other providers to help with your decision?

Accident?

Our team of experienced car accident lawyers are ready to help you assess your case and fight for the compensation you deserve. Don’t let the negligence of others dictate your future–let us be your advocate in this challenging time.