- Collision Coverage

- Why Choose First Acceptance Insurance in Georgia?

First Acceptance Insurance is a leading provider of auto insurance solutions tailored to meet the needs of Georgia drivers. With a focus on affordability and accessibility, First Acceptance Insurance provides flexible options that go beyond the state’s minimum requirements, offering peace of mind to drivers of all backgrounds. Whether you need essential liability coverage or comprehensive protection, First Acceptance Insurance ensures you have the tools and support to stay safe on the road.

What is First Acceptance Insurance?

First Acceptance Insurance specializes in providing affordable and straightforward auto insurance policies for drivers in Georgia and across the U.S. Known for its customer-first approach, this company caters to a wide range of drivers, including those who might face challenges securing coverage with traditional providers. First Acceptance is committed to delivering policies that balance affordability with the protection you need.

What sets First Acceptance apart is its willingness to work with drivers with diverse driving histories and circumstances, making it a trusted partner for those looking to meet legal requirements while staying within their budget.

Understanding Georgia’s Minimum Coverage Requirements

Like all Georgia insurers, First Acceptance adheres to the state’s minimum liability coverage requirements:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

While these limits satisfy the law, they may not be sufficient to cover the full costs of a serious accident. First Acceptance offers enhanced options that provide additional protection and peace of mind for drivers.

Key Coverages to Consider with First Acceptance Insurance

Liability Insurance

What It Covers: Meets Georgia’s legal requirements by covering medical expenses, property damage, and other liabilities if you’re at fault in an accident.

The Advantage: First Acceptance offers flexible liability limits to help you stay compliant while protecting your assets in case of a major accident.

Comprehensive Coverage

What It Covers: Non-collision-related incidents such as theft, vandalism, fire, and weather damage.

The Advantage: Comprehensive coverage through First Acceptance ensures your car is protected from Georgia’s unpredictable weather and other unforeseen risks.

Collision Coverage

What It Covers: Pays for repairs to your vehicle after an accident, regardless of fault.

The Advantage: Flexible deductible options allow you to manage costs effectively while ensuring your car can be repaired or replaced if needed.

Uninsured/Underinsured Motorist Coverage

What It Covers: Protects against financial losses when the at-fault driver doesn’t have enough or any insurance.

Why It’s Important: Georgia has a significant number of uninsured drivers, making this coverage essential for avoiding out-of-pocket expenses.

SR-22 Coverage

What It Covers: Helps high-risk drivers meet state requirements after a DUI, license suspension, or other violations.

The Advantage: First Acceptance specializes in SR-22 filings, ensuring drivers can get back on the road quickly and legally.

Roadside Assistance

What It Covers: Towing, flat tire assistance, fuel delivery, and lockout services.

The Advantage: First Acceptance provides 24/7 roadside assistance, ensuring help is always a call away during emergencies.

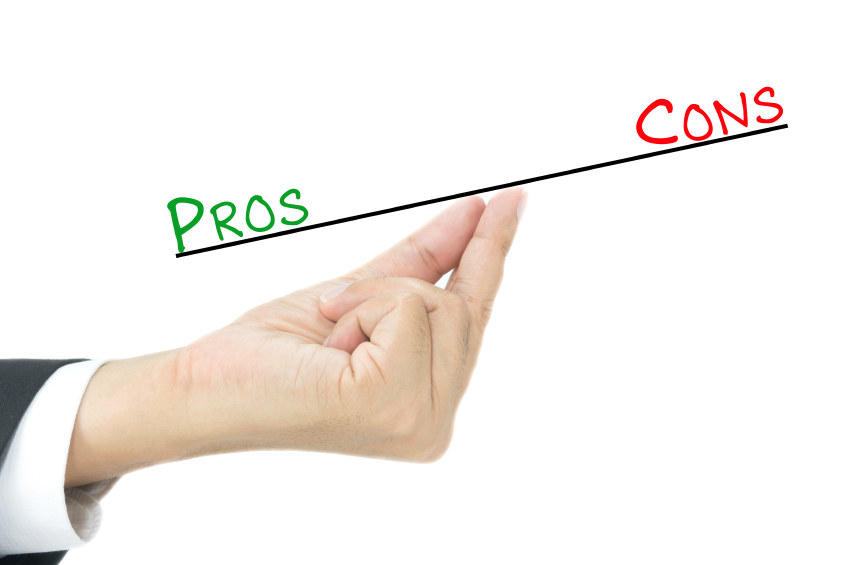

Pro and Con Chart for First Acceptance Insurance

| Coverage Feature | Pros | Cons |

|---|---|---|

| Liability Coverage | Meets legal requirements; customizable limits. | Minimum limits may not cover major accidents. |

| Comprehensive Coverage | Protects against non-collision damages. | Adds to overall premium cost. |

| Collision Coverage | Covers vehicle repairs regardless of fault. | Higher premiums for older vehicles. |

| Uninsured Motorist Coverage | Shields against uninsured drivers. | Increases total policy cost. |

| SR-22 Coverage | Simplifies compliance for high-risk drivers. | Only available for specific situations. |

| Roadside Assistance | Reliable support during breakdowns or emergencies. | Limited number of service calls per year. |

| Flexible Payment Plans | Allows budgeting with installment options. | May include fees for installment plans. |

Why Choose First Acceptance Insurance in Georgia?

First Acceptance Insurance is designed to provide accessible, budget-friendly options for drivers of all backgrounds. Here are key reasons to choose First Acceptance:

- Affordable Rates: Competitive pricing ensures you can get the coverage you need without breaking the bank.

- Flexible Payment Plans: Monthly, bi-weekly, or weekly payment options help you stay on budget.

- Customized Coverage: Tailored policies allow you to select the exact coverage that fits your driving needs and financial situation.

- Expert Support for High-Risk Drivers: First Acceptance specializes in helping drivers with past violations, ensuring access to legal coverage.

- User-Friendly Experience: Their online tools and mobile app make it easy to manage policies, make payments, and file claims.

Tips for Maximizing Your Coverage with First Acceptance Insurance

- Consider Higher Liability Limits: To avoid out-of-pocket costs in serious accidents, opt for limits beyond the state minimum.

- Explore Comprehensive Options: Protect your vehicle from weather-related damage, theft, and other non-collision risks.

- Take Advantage of Discounts: Ask about discounts for safe driving, bundling policies, or installing safety features in your car.

- Maintain a Clean Driving Record: Fewer violations mean better rates over time.

- Review Your Policy Annually: Adjust your coverage as your circumstances or vehicle needs change.

Additional Considerations for Georgia Drivers

- Unpredictable Weather: Georgia’s storms and hurricanes can lead to significant vehicle damage, making comprehensive coverage essential.

- Teen Drivers: First Acceptance offers affordable options and tools to help families manage coverage costs for young drivers.

- Urban Traffic Risks: Congested areas like Atlanta increase the likelihood of accidents, underscoring the importance of robust liability and collision coverage.

Accident?

Our team of experienced car accident professionals is ready to help you assess your case and fight for the compensation you deserve. Don’t let the negligence of others dictate your future–let us be your advocate in this challenging time. Contact us today at 770Goodlaw.