- Why Choose AssuranceAmerica Insurance in Georgia?

When it comes to protecting yourself and your vehicle, AssuranceAmerica Insurance offers a range of practical and affordable solutions tailored to meet the needs of Georgia drivers. Known for its focus on providing quality coverage at competitive prices, AssuranceAmerica is a trusted partner for individuals seeking reliable auto insurance. Whether you’re looking for basic liability protection or additional coverages to safeguard against unexpected expenses, AssuranceAmerica ensures that its policyholders have the support they need for peace of mind on the road.

What is AssuranceAmerica Insurance?

AssuranceAmerica Insurance specializes in providing affordable auto insurance solutions, particularly for drivers who may find it challenging to secure coverage through larger carriers. Established in 1998, the company has grown significantly by focusing on underserved markets and offering flexible, customer-focused policies. With a commitment to simplifying the insurance process, AssuranceAmerica caters to drivers across Georgia through a network of local agents and a user-friendly online platform.

By emphasizing affordability and accessibility, AssuranceAmerica ensures that its customers can meet state requirements while enjoying added protection that fits their budget and lifestyle.

Understanding Georgia’s Minimum Coverage Requirements

To drive legally in Georgia, all motorists must carry liability insurance with the following minimum limits:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage per accident

While these limits are mandated by law, they may not be sufficient to cover significant expenses in the event of a serious accident. AssuranceAmerica offers higher liability limits and optional coverages to help drivers avoid financial strain after unexpected incidents.

Key Coverages to Consider with AssuranceAmerica Insurance

Liability Coverage

What It Covers: Pays for damages or injuries to others in an at-fault accident.

The Advantage: AssuranceAmerica provides flexible limits to ensure drivers meet legal requirements and protect their assets.

Comprehensive Coverage

What It Covers: Protects against non-collision events, such as theft, vandalism, weather damage, and fire.

The Advantage: AssuranceAmerica offers competitive rates for comprehensive coverage, shielding drivers from unexpected losses.

Collision Coverage

What It Covers: Covers repair or replacement costs for your vehicle following an accident, regardless of fault.

The Advantage: AssuranceAmerica’s collision coverage can be customized to fit your vehicle’s value and your budget.

Uninsured/Underinsured Motorist Coverage

What It Covers: Protects against expenses from accidents caused by drivers with insufficient or no insurance.

Why It’s Important: With a significant number of uninsured drivers in Georgia, this coverage is essential for financial security.

Roadside Assistance

What It Covers: Includes towing, flat tire changes, lockout services, and other emergency roadside needs.

The Advantage: AssuranceAmerica’s roadside assistance provides peace of mind during breakdowns and emergencies.

Rental Reimbursement Coverage

What It Covers: Pays for a rental car while your vehicle is being repaired after a covered loss.

The Advantage: AssuranceAmerica ensures you won’t be left without transportation, offering affordable options for this add-on.

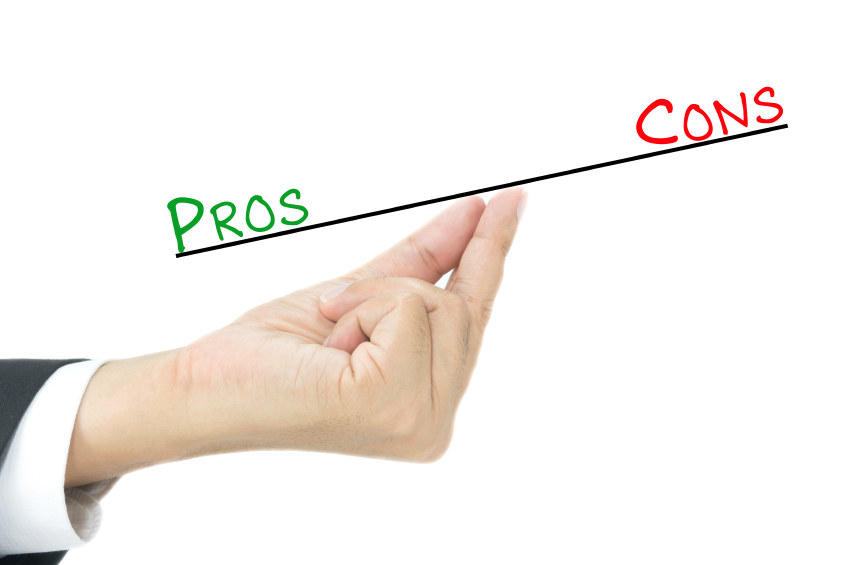

Pro and Con Chart for AssuranceAmerica Insurance

| Coverage Feature | Pros | Cons |

|---|---|---|

| Liability Coverage | Meets Georgia’s legal requirements; flexible limits. | Minimum limits may not cover major accidents. |

| Comprehensive Coverage | Protects against non-collision risks like weather damage. | Adds to overall premium costs. |

| Collision Coverage | Covers repairs regardless of fault. | Deductible applies to claims. |

| Uninsured Motorist Coverage | Shields against uninsured/underinsured drivers. | May increase premium costs. |

| Roadside Assistance | Reliable emergency support. | Limited service calls per policy term. |

| Rental Reimbursement | Covers rental expenses during repairs. | Daily and total limits may apply. |

Why Choose AssuranceAmerica Insurance in Georgia?

AssuranceAmerica Insurance is an excellent choice for Georgia drivers seeking affordability, flexibility, and quality service. Here’s why:

- Affordable Options: AssuranceAmerica focuses on providing budget-friendly policies for drivers across various financial situations.

- Flexible Payment Plans: The company offers multiple payment options to fit individual budgets.

- Local Expertise: With agents across Georgia, AssuranceAmerica understands the specific needs and risks of local drivers.

- Simplified Claims Process: AssuranceAmerica is committed to resolving claims quickly and efficiently, ensuring drivers get back on the road without unnecessary delays.

- Specialized Coverage: The company caters to high-risk drivers, offering tailored solutions that may not be available from other providers.

Tips for Maximizing Your Coverage with AssuranceAmerica Insurance

- Opt for Higher Liability Limits: Protect yourself from costly lawsuits and financial losses by choosing limits beyond Georgia’s minimum requirements.

- Bundle Coverages: Combine multiple coverages under a single policy for potential discounts.

- Maintain a Safe Driving Record: AssuranceAmerica rewards safe drivers with lower premiums and other incentives.

- Review Your Policy Regularly: Adjust your coverage as your circumstances change to ensure adequate protection.

- Explore Discounts: Take advantage of discounts for good driving habits, vehicle safety features, and more.

Additional Considerations for Georgia Drivers

- Seasonal Risks: Georgia’s unpredictable weather, including storms and hurricanes, highlights the importance of comprehensive coverage.

- High-Risk Drivers: AssuranceAmerica specializes in serving drivers with less-than-perfect records, providing affordable solutions tailored to their needs.

- Urban Traffic Hazards: Congested areas like Atlanta increase the likelihood of accidents, emphasizing the need for robust coverage.

Accident?

Our team of experienced car accident professionals is ready to help you assess your case and fight for the compensation you deserve. Don’t let the negligence of others dictate your future–let us be your advocate in this challenging time. Contact us today at 770Goodlaw.